Our share

The Hoist Finance share has been listed on Nasdaq Stockholm’s Mid Cap list since 25 March 2015. Hoist Finance’s market capitalisation was SEK 2,608 million based on the last price paid on 30 December 2021, which was SEK 29.20 per share.

Trading

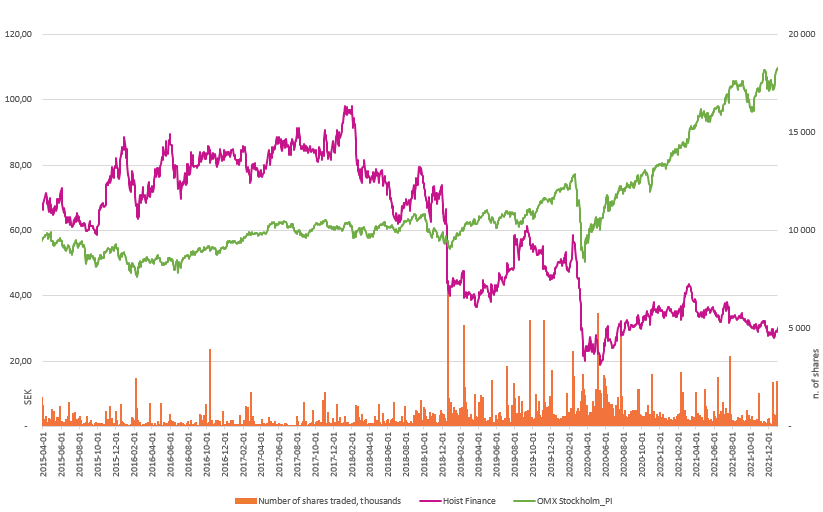

In all, 109 million (192) Hoist Finance shares were traded in 2021 with an average daily trading volume of 431 439 (762,275) shares. Nasdaq accounted for 57.4% of the total trading in Hoist Finance shares.

Hoist Finance’s share price decreased 19.9 per cent in 2021, while the total OMX Stockholm PI index increased 35.0 per cent. The highest price quoted during the year was SEK 44.40, on 8 March 2021, and the lowest price was SEK 26.80, on 20 December 2021.

Share capital

The total number of shares is 89,303,000. Each share has a nominal value of SEK 0.33, and total share capital 29,767,667. Hoist Finance’s share capital derives from one type of share where each share has the same voting rights and the same right to dividends. There is no provision in Hoist Finance’s articles of association that limits the right to transfer shares or any voting right restrictions as to how many votes a shareholder may exercise at a shareholders’ meeting. Hoist Finance does not hold any of its own shares, nor has it issued any shares in 2021. Hoist Finance is unaware of any agreement between shareholders that may entail restrictions on the right to transfer shares in the company.

Ownership structure

As of December 31, 2021, Hoist Finance had 6 035 shareholders (6 877). Approximately 14.7% of the shares (15,1) were registered to foreign accounts. The fifteen largest individual shareholders represented 65.9% (65.2) of the share capital.

Dividend

Hoist Finance dividend will in the long-term correspond to 25-30 per cent of annual net profit. The dividend will be determined annually with respect to the company’s capital target and the outlook for profitable growth. As the annual net profit is negative for the financial year 2021, the Board of Directors will recommend that the Annual General Meeting resolve not to pay a dividend for 2021.

Credit rating

Hoist Finance has a long-term senior unsecured debt rating of Baa3, with a stable outlook. The short-term credit score is P-3. The credit rating is completed by the rating agency Moody’s Investors and was confirmed in October 2021.

Hoist Finance share data 2021 | ||

|---|---|---|

| Ticker | HOFI | |

| ISIN code | SE0006887063 | |

| Total turnover, SEK | 6,470,414,280 | |

| Total turnover, number of shares | 185,742,254 | |

| Daily average turnover, SEK | 25,574,760 | |

| Daily average turnover, number shares | 746,541 | |

| Average daily turnover velocity, % | 0.84 | |

| Stake of turnover number of shares on Nasdaq, % | 57.38 | |

| Lowest price, SEK | 26.80 | |

| Highest price, SEK | 44.40 | |

1) Source: Modular Finance AB.

Ownership structure, 31 December 202 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Size | Number of shares | Capital, % | Votes, % | No. of shareholders | Market value, KSEK | |||||

| 1–500 | 560,087 | 0.63 | 0.63 | 3,448 | 16,355 | |||||

| 501–1,000 | 700,562 | 0.78 | 0.78 | 842 | 20,456 | |||||

| 1,001–5,000 | 2,815,062 | 3.15 | 3.15 | 1.090 | 82,200 | |||||

| 5,001–10,000 | 2,119,568 | 2.37 | 2.37 | 273 | 61,891 | |||||

| 10,001–15,000 | 1,038,869 | 1.16 | 1.16 | 81 | 30,335 | |||||

| 15,001–20,000 | 1,289,305 | 1.44 | 1.44 | 70 | 37,648 | |||||

| 20,001 | 80,779,547 | 83.6 | 83.6 | 231 | 2,358,763 | |||||

| Total | 89,303,000 | 100.0 | 100.0 | 6,035 | 100.0 | |||||

Source: Modular Finance AB

Largest shareholders, 31 December 2021 | ||

|---|---|---|

| Share of capital and votes, % | ||

| Per Arwidsson through closely related persons' holding | 15.7% | |

| Erik Selin | 14.0% | |

| Avanza Pension | 8.2% | |

| Swedbank Robur Fonder | 6.7% | |

| C WorldWide Asset Management | 4.7% | |

| BlackRock | 4.2% | |

| Per Josefsson privately and through company | 2.8% | |

| Dimensional Fund Advisors | 2.7% | |

| RAM Rational Asset Management | 1.6% | |

| Holberg Funds | 1.5% | |

| Arbona AB (publ) | 1.3% | |

| Nordnet Pensions Insurance | 1.2% | |

| Handelsbanken Funds | 0.7% | |

| The Kamprad family's foundation | 0.7% | |

| Nordea Liv & Pension | 0.6% | |

| Total 15 largest shareholders | 65.9% | |

| Other shareholders | 34.1% | |

| Total | 100.0% | |

Source: Modular Finance AB

Hoist Finance, 25 March 2015 - 30 December 2021